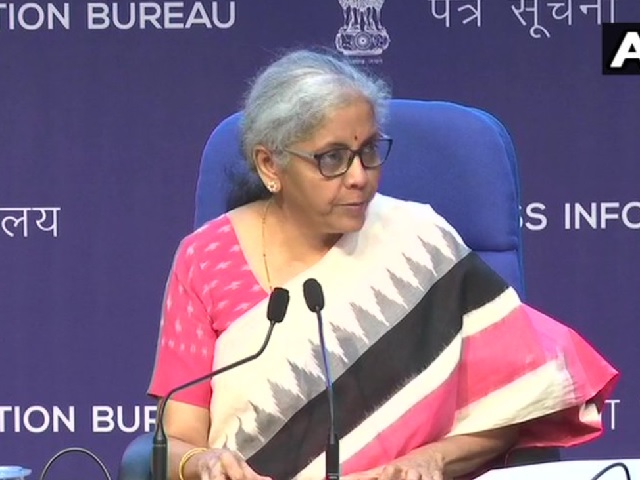

The Union Finance Minister Nirmala Sitharaman on June 28, 2021, announced series of relief measures for various sectors including the health infrastructure.

As different sectors in the country make efforts to revive the economy from the devastating impact of the COVID-19 pandemic, the government has come up with various measures including Rs. 1.1 lakh crore loan guarantee scheme for the COVID affected and an additional Rs. 1.5 lakh crore under the Emergency Credit Line Guarantee Scheme.

The Finance Minister in her latest briefing announced 8 measures, out of which she informed four were new initiatives. Check key points below.

We are announcing about 8 economic relief measures, of which four are absolutely new & one is specific to health infrastructure. For Covid-affected areas, Rs 1.1 lakh crores credit guarantee scheme and Rs 50,000 crores for health sector: Union Finance Minister Nirmala Sitharaman pic.twitter.com/vsZPnQMiqa

— ANI (@ANI)

June 28, 2021

1. Loan Guarantee Scheme for COVID-19 affected sectors

• The Union Finance Minister announced a loan guarantee scheme of Rs. 1.1 lakh crores.

• Out of this amount, Rs. 50,000 crores have been allocated to the health sector, with a focus on the improvement of health infrastructure outside the 8 metropolitan cities, especially in tier 2 and tier 3 cities and aspirational districts.

• The Loan Guarantee scheme will help the existing projects with 50% of the required amount for an expansion, while the new projects can avail 75% of the required funds through the scheme. In the aspirational districts, both the new and existing projects will be eligible for 75% coverage.

• The maximum loan disbursed through the loan guarantee scheme will be capped at Rs. 100 crores and the guarantee will be extended for 3 years. The interest rate for the loan scheme will be capped at 7.95% per annum (p.a).

• The remaining amount of Rs. 60,000 crores in the scheme will be disbursed to other sectors at an interest rate of 8.25 per cent (p.a.).

2. New scheme for Public Health with a focus on paediatric care

The Finance Minister has made an additional outlay of Rs. 23,220 crores or the public health, which will include a new scheme focused on short term emergency preparedness with a special emphasis on children and paediatric care/beds.

Significance-

The funds will be utilized to increase the staff strength, including nurses and interns, doctors, in hospitals and covid centres; increasing the availability of ICU beds and oxygen supply at the Central, district and sub-district levels; ensuring the availability of medicines, essential medical equipment, ambulance and teleconsultation services; and, enhancing the covid testing capacity and supportive diagnostics.

Rs. 23,220 crores for public health, special focus on child & pediatric care. It will also include HR augmentation to rope in medical students, nurses; strengthening medical infrastructure. The said amount to be spent in this financial year itself: MoS Finance Anurag Thakur pic.twitter.com/SibzkIRhFe

— ANI (@ANI)

June 28, 2021

3. New Credit Guarantee Scheme

The Finance Ministry has announced the Credit Guarantee Scheme in order to facilitate loans to 25 lakh individuals through micro-financial institutions and commercial banks. Most of the people will be small-time borrowers.

The amount per loan will be capped at Rs. 1.25 lakh with an interest rate of MCLR plus 2 per cent.

Under Credit Guarantee Scheme, which is a new scheme, 25 lakh people to be benefitted. Loan to be given to the smallest borrowers by Microfinance Institutions. A maximum Rs 1.25 lakhs amount to be lent. Focus is on new lending & not on repayment of old loans: Finance Minister pic.twitter.com/WGiyBZ6Pd7

— ANI (@ANI)

June 28, 2021

4. Free tourist visas, working capital loans for tourist guides

• The new initiatives by the Union Government also included a scheme to revive the tourism sector by providing financial support to 11,000 registered tourist guides and other industry stakeholders.

• The financial support by the government will be through the working capital/personal loans and it will cover 10,700 regional level tourist guides empanelled with the Tourism Ministry or any other State Government.

To revive tourism, the new loan guarantee scheme will support 10,700 regional level tourist guides and Travel & Tourism stakeholders (TTS) recognized by the Ministry of Tourism and the State governments: Finance Minister Nirmala Sitharaman pic.twitter.com/EohsxQ6Kd7

— ANI (@ANI)

June 28, 2021

• The loans will be provided with a 100% guarantee, with an amount capped at $1 million per travel and tourism agency and Rs. 1,00,000 for tourist guides.

Free Tourist visas-

To boost tourism, when India will resume issuing tourist visas, the first 5,00,000 tourist visas will be issued for free. The benefit by the government will be applicable only once per tourist and will be applicable till March 31, 2022, or till the first 5,00,000 visas are issued, whichever is earlier.

Once international travel resumes, first 5 lakh tourists who come to India will not have to pay visa fees. Scheme applicable till March 31, 2022, or will be closed after distribution of first 5 lakh visas. One tourist can avail benefit only once: Finance Min Nirmala Sitharaman pic.twitter.com/RnLXu9D8lo

— ANI (@ANI)

June 28, 2021

5. Extension of Atmanirbhar Bharat Rozgar Yojana

The scheme launched by the government to incentivize job creation and restoration has now been extended from June 30, 2021, to March 31, 2022.

Atmanirbhar Bharat Rozgar Yojana has now been extended from June 30, 2021, to March 31, 2022. Over 21.4 lakh people of nearly 80,000 establishments have already benefited from the scheme: Finance Minister pic.twitter.com/0DEjIkTU7N

— ANI (@ANI)

June 28, 2021

More than 21.4 lakh people of around 80,000 establishments have been benefitted from the scheme.

About job scheme-

It incentivizes the employers for the creation of new employment and the restoration of loss of employment through EPFO (Employees’ Provident Fund Organisation).

According to the Finance Ministry, as of June 2021, benefits worth Rs. 902 crores had been provided to 21.42 lakh beneficiaries of 79,577 establishments.

6. Additional subsidy by the government for fertilisers

• Reiterating the scheme that was announced earlier, Sitharaman reiterated that the existing Nutrient Based Subsidy (NBS) was worth Rs. 27,500 crores in FY21, which has now been increased to Rs. 42,275 crores in FY22.

• Out of the additional Rs. 14,775 crores to be provided, Rs. 9,125 crores additional subsidy will be for DAP fertilisers and Rs. 5,650 crores will be for NPK based complex fertilizer.

7. Pradhan Mantri Garib Kalyan Yojana extended

As per the announcement made by PM Modi, the Finance Minister reiterated that the scheme, which was earlier in plan till November 2020, was relaunched again in May 2021 to ensure food security to vulnerable section amid the second wave.

According to the scheme, 5 kg of foodgrains will be provided for free to the beneficiaries of the National Food Security Act.

In FY21, the total cost of the Government’s scheme was Rs. 1,33,972 crores. For 2021, the estimated financial implication of the scheme’s extension will be Rs. 93,869 crores.

The financial expenditure on the free distribution of ration to poor people this year will be Rs 93,869 crores. The total money spent on Pradhan Mantri Garib Kalyan Anna Yojana will be Rs 2,27,841 crores: MoS Finance Anurag Thakur pic.twitter.com/Q4PjCDNB15

— ANI (@ANI)

June 28, 2021

8. Scope of Emergency Credit Line Guarantee Scheme expanded

The Finance Minister announced more schemes to alleviate the financial stress in various industries amid the pandemic.

The Government has expanded the scope of the Emergency Credit Line Guarantee Scheme (ECLGS) which was first launched as part of the Atmanirbhar Bharat Package in May 2020.

The overall cap of the admissible guarantee will be increased from Rs. 3 lakh crores to Rs. 4.5 lakh crores, with sector-wise details to be finalized as per the evolving needs.

Emergency Credit Line Guarantee Scheme, to date, has seen Rs. 2.69 trillion in credit disbursal 1.1 crore units through the private banks, public sector banks and non-banking financial companies.

Background:

The announcements by the Union Government have come at a time when the major economic sectors are emerging from the second wave of pandemic and are bracing for a possible third wave.